Company Name and Business Overview

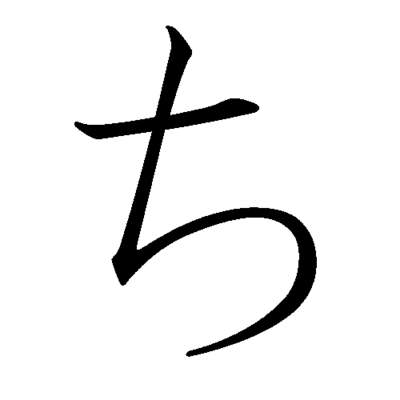

Company Name: Tabio Co., Ltd.

Business Overview: Tabio Co., Ltd. is primarily engaged in the manufacturing and sales of socks and related products. The company operates a widespread sales network both domestically and internationally, offering high-quality, fashionable, and functional socks. The company has a diverse product lineup, including sports socks and socks made from organic cotton, aimed at meeting various customer needs.

Overall Business Performance Summary

For the first quarter of FY2025, Tabio Co., Ltd. reported a 4.9% increase in sales compared to the same period last year. However, operating profit, ordinary profit, and net profit attributable to parent company shareholders all declined. Operating profit decreased by 2.1%, ordinary profit by 2.0%, and net profit by 28.7%. The increase in sales was driven by various initiatives, but higher raw material costs and other expenses impacted profitability.

Detailed Analysis: Financial Status, Earnings Forecast, Risk Factors, and Strategic Perspectives

Financial Status

Total Assets: ¥8,626 million (up ¥946 million from the previous fiscal year-end) Total Liabilities: ¥4,209 million (up ¥1,001 million from the previous fiscal year-end) Total Net Assets: ¥4,417 million (down ¥54 million from the previous fiscal year-end) Equity Ratio: 51.2% (down from 58.2%)

Tabio Co., Ltd. saw an increase in total assets due to a rise in receivables, cash and deposits, and inventory. Liabilities also increased, mainly due to higher long-term loans payable and other current liabilities. As a result, the equity ratio decreased.

Earnings Forecast

For the full fiscal year ending February 2025, the company maintains its forecast as follows:

- Net Sales: ¥16,561 million (up 2.1% year-on-year)

- Operating Profit: ¥684 million (up 14.3% year-on-year)

- Ordinary Profit: ¥689 million (up 10.9% year-on-year)

- Net Profit: ¥510 million (up 8.7% year-on-year)

- Earnings per Share: ¥75.04

The forecast indicates modest growth in sales and profits, driven by both domestic and international market expansion and efforts to increase customer loyalty.

Risk Factors

- Market Competition: The sock market is highly competitive, with intense price competition and the need for continuous innovation to maintain market share.

- Cost Increases: Rising raw material costs and other operational expenses could impact profit margins.

- Economic Conditions: Fluctuations in the domestic and global economy, as well as currency exchange rates, could affect the company’s financial performance.

Strategic Perspectives

- Product and Brand Development: The company focuses on enhancing its brand value through collaborations, such as the partnership with FC Barcelona for sports socks, and launching special projects like the “SOCKSUN” collaboration with Naigai Co., Ltd.

- Market Expansion: Tabio aims to expand its presence in both domestic and international markets, leveraging its strong product lineup and strategic partnerships.

- Digital and Marketing Initiatives: Strengthening online sales channels and marketing efforts to attract new customers and retain existing ones, including significant investments in advertising and promotional activities.

These strategies are designed to reinforce Tabio’s market position and drive sustainable growth in a competitive environment.